Article published in invest.ch on 11.03.2021

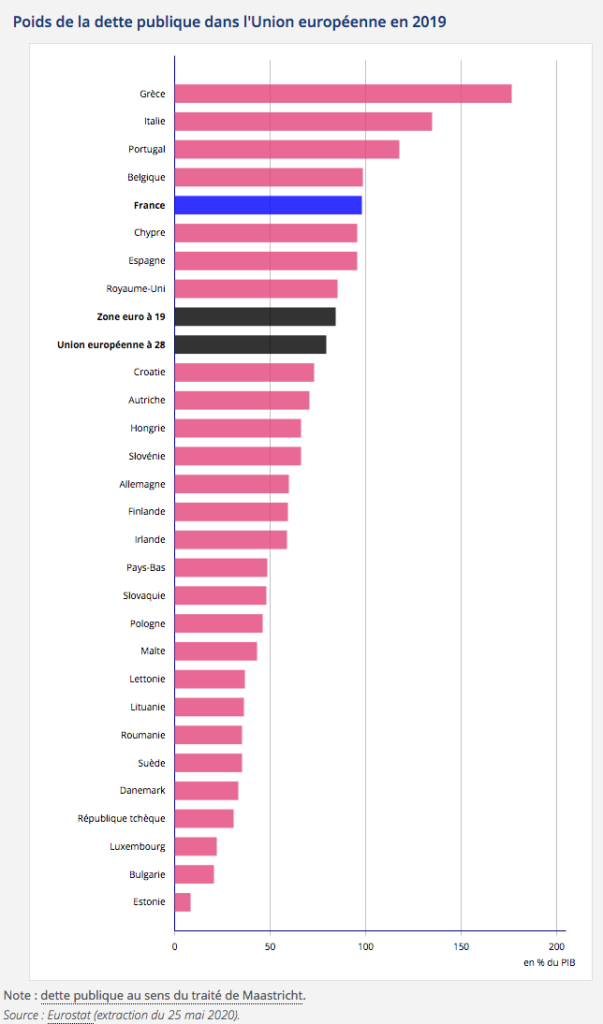

One more time, the future of public debt has returned to center stage this month. It must be said that by winning 20 points of GDP in the space of a year in France and at least 30 Points in Italy, there is reason to ask the question.

By Christophe Lhote, Senior Advisor

First reaction from the general public, it will never be refunded. Which political leaders immediately rush to deny since any idea to the contrary would be devastating for its refinancing and would lead to immediate bankruptcy. And when we know that your pension fund is stuffed with it... Not counting the coffers of the SNB... it would be very effective in weakening an overly expensive Swiss franc!

Non, the most interesting topic this month, this is the appeal launched to the European institutions by more than 100 economists to demand the cancellation of the 3,700 billion euros “held for monetary policy purposes” by the European Central Bank (and financed on its balance sheet, in the passive of course !), an amount which still represents almost 25% of state debt. A measure immediately deemed “unthinkable” by Christine Lagarde for whom canceling the debt would be “a violation of the European treaty which strictly prohibits the monetary financing of States”.

That's right, the ECB does not buy government bonds on issue, but... the next day on the secondary market (leaving a small commission to the credit institutions for the service provided). If the sleight of hand put in place by Mario Draghi does not violate the European treaty, we are still not very far from it; so canceling the debt would not be a big step forward, economists argue. No at the moment, but the idea is there and will make its way. Because if Christine Lagarde is counting on a sustained and job-creating recovery from this year, she is alone in thinking that this will be enough to reverse the trend.

Waiting, the amount of the Covid-19 bill for the whole year 2020 begins to reveal itself: it will be -8.3% of GDP for France (-193.8 bn, dont -86.1 household consumption bn), and -9.9% for the UK.

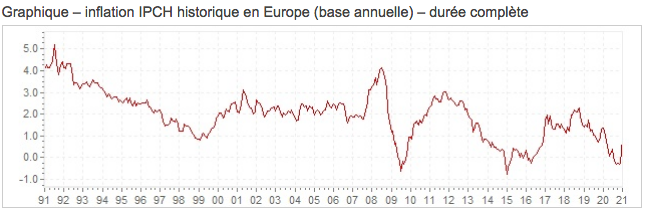

Another subject that is starting to get people talking: l’inflation. Because raw materials are at their highest, and how to explain that, despite teleworking and three quarters of planes grounded, oil has returned to 63 dollars (WTI) when it was no longer worth anything last April? How much will it rise when the recovery (and therefore the demand) will be there? And if inflation returns, there will be an end to gratuitous debts...