| AMC PERPETUEL CAPITAL – USD | |

|---|---|

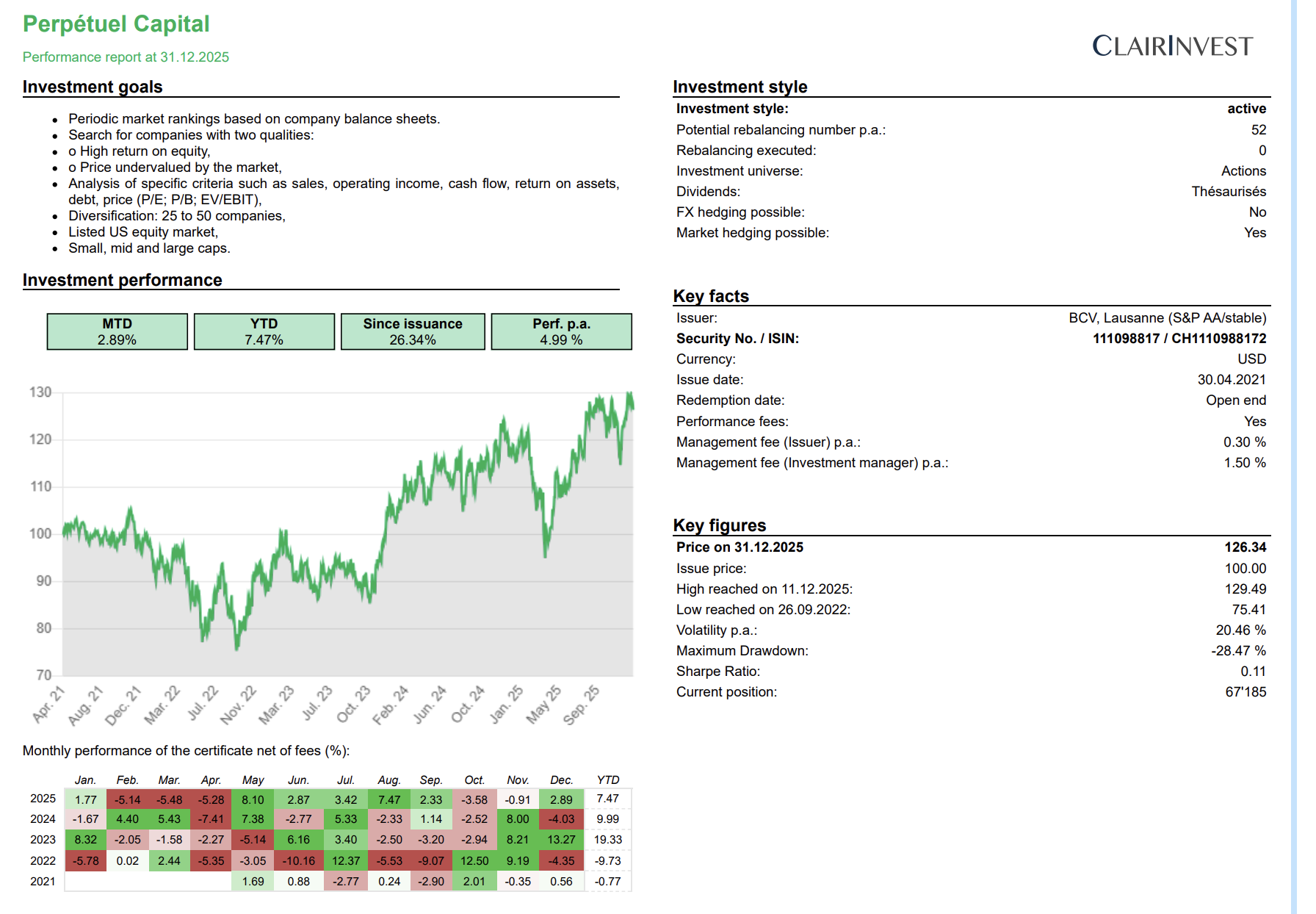

| Share price on 31.12.2025 | USD 126,34 |

| ISIN | CH1110988172 |

| Last weekly report- in English |

OBJECTIVE

Capital preservation and maximization of long-term returns.

STRATEGY

- Periodic market ranking based on corporate balance sheets.

- Search for companies with two qualities :

- Strong return on equity,

- Price undervalued by the market.

- Analysis of specific criteria such as : turnover, Operating income, cash-flows, profitability of assets, this, prix (P/E ; P/B ; EV/EBIT) …

- Diversification : 25 to 50 companies.

INVESTMENT PERIOD AND LIQUIDITY

- Minimum 5 years recommended, in order to limit the risks of market movements.

- Daily liquidity.

INVESTMENT UNIVERSE

- US Listed Stock Market.

- Small, medium, large caps.

BENCHMARK

- Strategy without short-term benchmark constraints

- Allows the manager to focus on long-term market opportunities.

Date of issue: 30.04.2021.

L'AMC AND DETAILS

Performance is net of fees.

| Legal structure: Certificat Tracker AMC (Actively Managed Certificate) | Issuer and lead manager: Vaud Cantonal Bank (AA Standard & Poor’s) |

| ISIN number: CH1110988172 | Paying agent: Vaud Cantonal Bank |

| Security number: 111 098 817 | Basket Calculation Agent: Vaud Cantonal Bank |

| Issue price: USD 100 | Advisor: Clairinvest SARL |

| Initial Valuation Date: 30.04.2021 | Prudential supervision: BCV Lausanne is subject to the supervision of the Swiss Financial Market Supervisory Authority (FINMA). Clairinvest is affiliated with the Association Romande des Intermédiaires Financiers (ARIF) |

| Liquidity: daily | Minimum investment: 1 certificate |

Any information can be obtained from the BCV sales team – Telephone: 00.41.21.212.42.00 – email: structures@bcv.ch – mail: BCV 276-1598 CP 300 1001 Lausanne Switzerland

| Security number | 111 098 817 |

| Code ISIN | CH111098817 |

| Minimum investment | 1 certificate |

| Issue price | USD 100.00 |

| Devise | USD |

| Repayment date | Open-end |

| Management fees | 1.80% |

| Rebalancing fees | 0.10% |

| Performance fee | 15% with Quarterly High Water Mark |

| Subscription fees | 0% |

| Redemption fees | 1% |