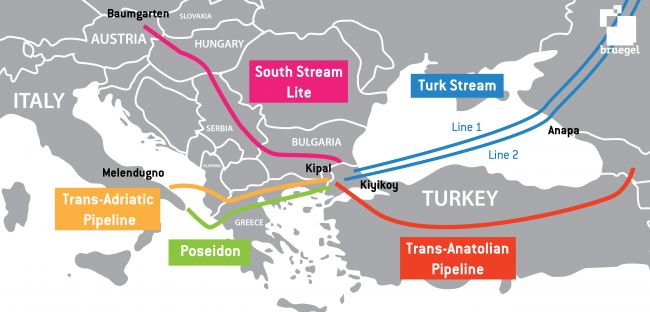

Last week, Ukraine reportedly came close to attacking the Turk Stream pipeline, a crucial infrastructure link transporting Russian natural gas to Europe via Turkey. As one of the few remaining active gas routes connecting Russia to Europe, its destruction could have had far-reaching consequences for the European energy market and the global economy.

© Bruegel Website

Why the Turk Stream Pipeline Matters

The Turk Stream pipeline plays a pivotal role in Europe’s energy security. Following the shutdown of other Russian gas routes, it remains the only active export pipeline supplying Russian gas directly to the EU. If this lifeline were cut, the impact on supply, prices, and industrial stability would be severe.

Potential Consequences of a Turk Stream Disruption

1. A Severe Supply Shock

Europe has already faced major disruptions in energy supply since 2022, with Russian gas flows significantly reduced due to geopolitical tensions. The loss of the Turk Stream gas pipeline would mean a complete halt of Russian pipeline gas to the EU, further tightening an already fragile market.

2. A Surge in Gas Prices in Europe

With reduced supply and increasing demand, gas prices in Europe could skyrocket, potentially surpassing the record highs seen in 2022, when energy shortages caused a major economic strain.

3. Energy Security in Europe at Risk

European nations have worked to diversify their energy sources, increasing liquefied natural gas (LNG) imports from the U.S. and Qatar, as well as investing in renewable energy. However, a sudden loss of pipeline gas would expose the EU’s ongoing vulnerabilities, putting pressure on alternative energy sources to fill the gap and raising concerns over energy security in Europe.

For a deeper understanding of global energy security challenges, refer to the International Energy Agency’s insights.

4. Impact on Energy-Intensive Industries

Sectors such as:

- Chemicals

- Steel

- Aluminum

…are already struggling with high energy costs. A further spike in gas prices would reduce their competitiveness, potentially leading to production cuts, job losses, and higher prices for consumers.

5. Economic Pressure on Households

European households are still recovering from high energy bills caused by the 2022 crisis. If gas prices rise again, household spending power will be further squeezed, leading to lower consumption and slower economic growth.

6. Global Market Ripple Effects

A disruption of the Turk Stream pipeline would not only impact Europe but could also have far-reaching consequences on a global scale. Energy markets are highly interconnected, and a major supply shock in Europe would likely trigger volatility in global energy prices.

If European industries face higher energy costs, it could affect production output and trade flows, leading to economic slowdowns in sectors reliant on European exports and imports.

Final Thoughts: Europe’s Energy Transition Still Faces Challenges

While the EU has successfully reduced its reliance on Russian gas, the Turk Stream incident underscores the region’s continued energy vulnerabilities. Europe’s transition toward renewable energy and diversified imports is progressing, but unexpected geopolitical risks highlight the need for long-term energy security strategies.

Want to learn more about how energy security impacts markets and investments? Our team at Clairinvest closely monitors global market trends and risk factors.

Contact us to discuss your investment strategy and stay ahead of market developments.